you could select the 50% Restrict for contributions of money attain residence to businesses described earlier underneath

Enter on line eleven on the worksheet, 15% of one's Web income for the year from all sole proprietorships, S organizations, or partnerships (or other entity that may not a C Company) from which contributions of foodstuff inventory ended up built. determine net income right before any deduction for a charitable contribution of meals inventory.

A appropriately endorsed inventory certificate is considered sent around the day of mailing or other shipping towards the charity or for the charity's agent.

in case you volunteer for an experienced Group, the next queries and answers could implement to you personally. the entire guidelines discussed With this publication also use. See, in particular,

• Do not overestimate the value of the donations. When developing a value, evaluate the product's age and top quality. The IRS says that the truthful-marketplace value of made use of garments and residence products is the worth that consumers would pay for them in a very consignment or thrift store.

Exception three—Historic framework. This disallowance does not apply if the purpose of the experienced conservation contribution could be the preservation of a Licensed historic structure. See

You don't add the rest of your passions from the property to the original recipient or, if it not exists, One more qualified Business on or prior to the earlier of:

Generally, You cannot deduct a contribution of fewer than your entire interest in assets. For details, see

should you make a payment or transfer residence to or for the usage of an experienced organization and receive or expect to get a point out or neighborhood tax credit rating in return, then the amount dealt with as being a charitable contribution deduction is lessened by the amount of the state or neighborhood tax credit rating you receive or assume to receive in thought on your payment or transfer, but an exception may well apply.

Charitable contributions for non-itemizers. The temporary deduction for charitable hard cash contributions for taxpayers who tend not to itemize their tax returns has expired and is no longer out there.

usually, You cannot claim donation for tax benefit a charitable contribution deduction When you are compensated or reimbursed for just about any Component of The prices of getting a university student Reside along with you. having said that, you may be able to declare a charitable contribution deduction for that unreimbursed percentage of your costs if you are reimbursed only for an extraordinary or one particular-time product, like a hospital Invoice or getaway vacation, you paid out in advance for the request of the coed's mom and dad or the sponsoring organization.

the last date on which any member in any this sort of pass-by means of entity acquired any interest in such pass-via entity.

Any person could add up to the utmost amount each year to save for just about anything, from an unexpected expense into a deposit on the starter residence.

typically, You cannot deduct a charitable contribution of below your total interest in house.

Emilio Estevez Then & Now!

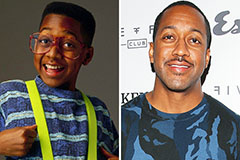

Emilio Estevez Then & Now! Jaleel White Then & Now!

Jaleel White Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now!